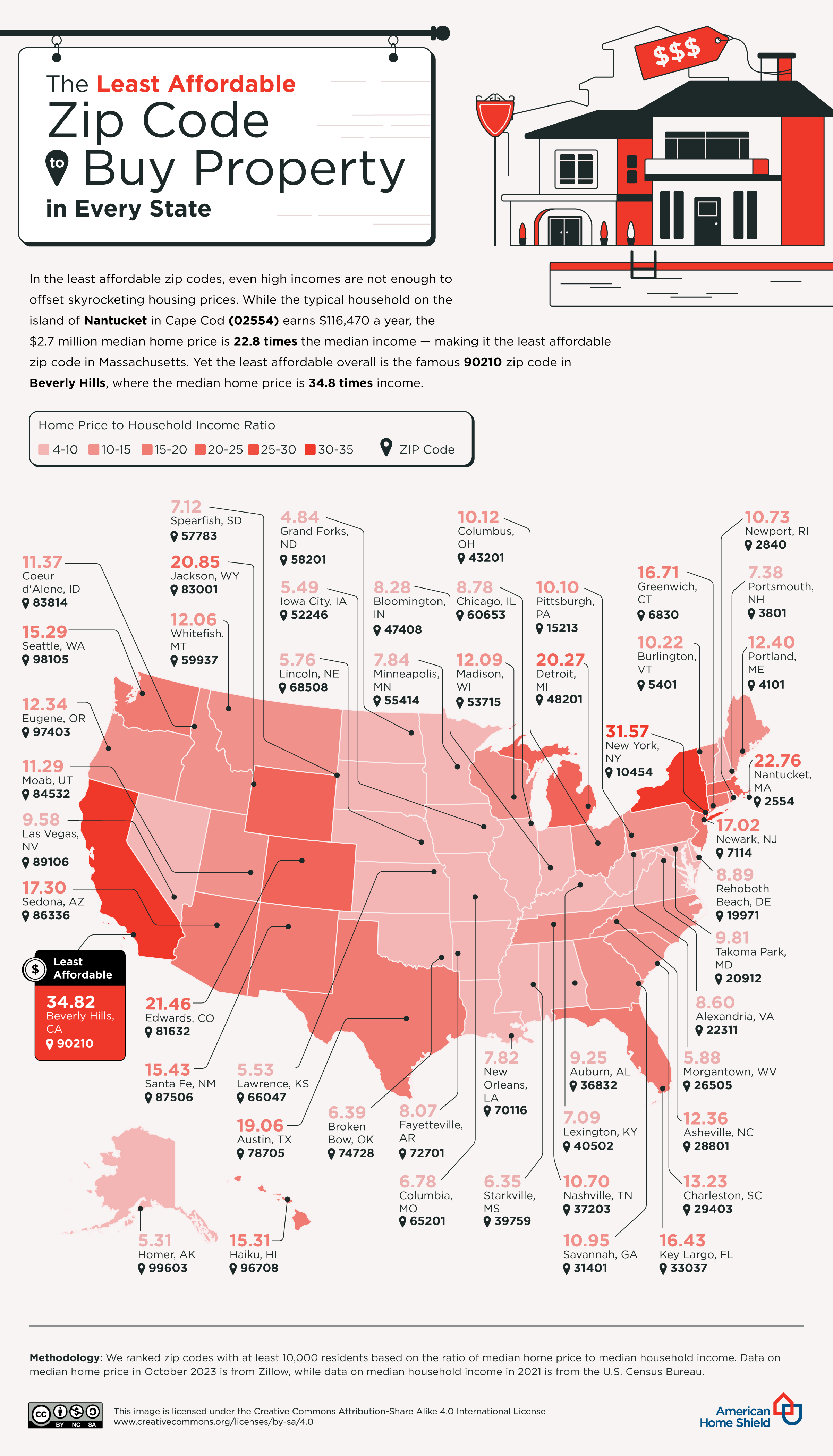

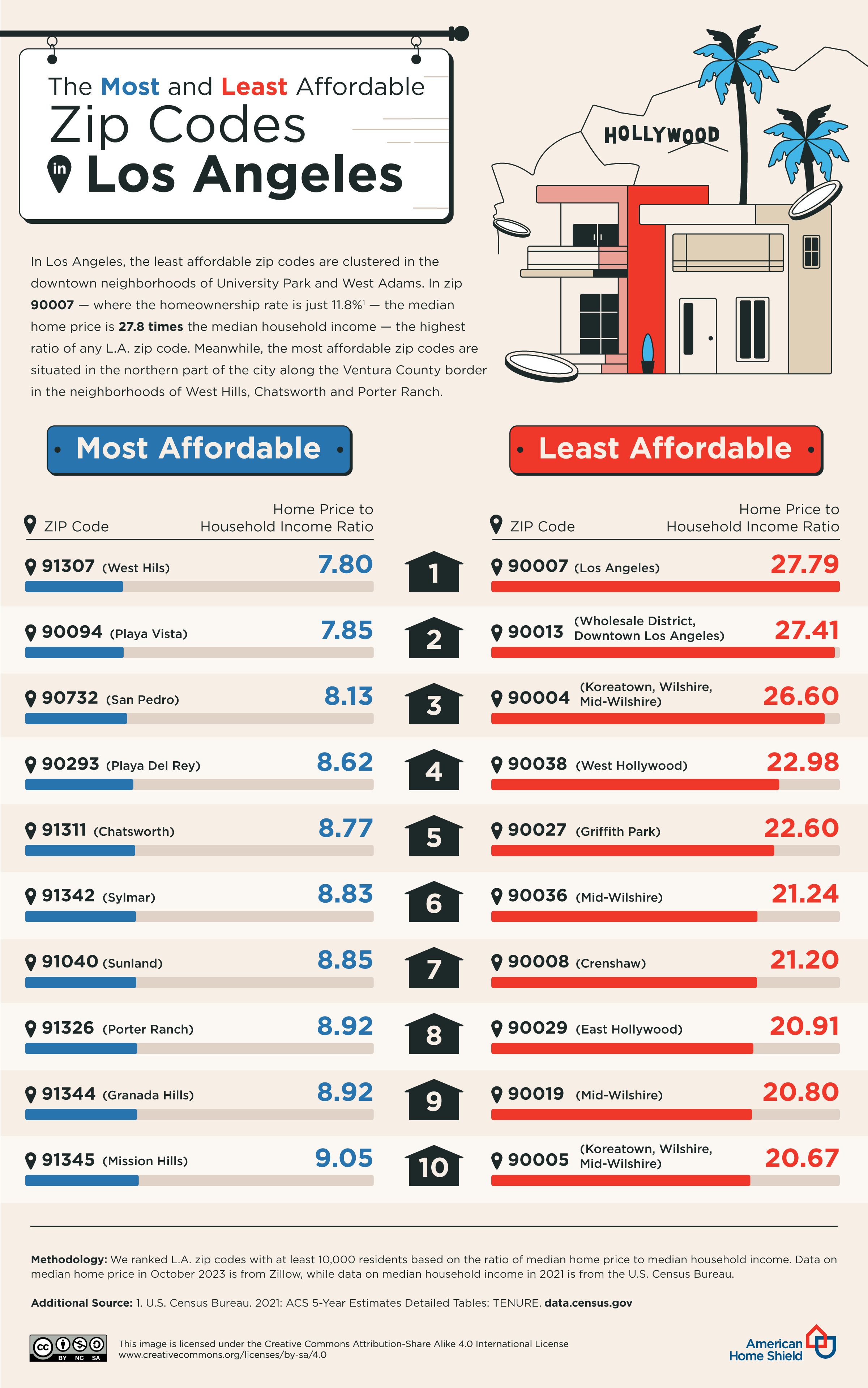

That figure also doesn’t paint much of a picture of the sheer range in house prices across the country. Sure, we know that homes in the sun-dappled states of Hawaii and California tend to carry much higher price tags than any other. We also know that the average property in glitzy cities like New York and San Francisco goes for hundreds of thousands of dollars more than in a rural town.

But how much do house prices change on a neighborhood-to-neighborhood level? And can the people who actually live in these neighborhoods afford to buy a house at all? To find out, American Home Shield went in search of the most and least affordable ZIP codes for local residents to buy a home in the U.S. While property prices vary, having a home warranty can offer protection for your home’s systems and appliances, no matter the location.

What We Did

We first used a U.S. Census databank to retrieve the population of every ZIP code in the U.S. with more than 10,000 residents. For each ZIP code, we then gathered the median home price (from Zillow) and the median household income (from U.S. Census data). We then divided each ZIP code’s median home value by the median household income, giving us a home price-to-household income ratio. The last step was to rank the most affordable (i.e., the lowest ratio) and least affordable (highest ratio) ZIP codes in the country for locals to buy a house.

Key Findings

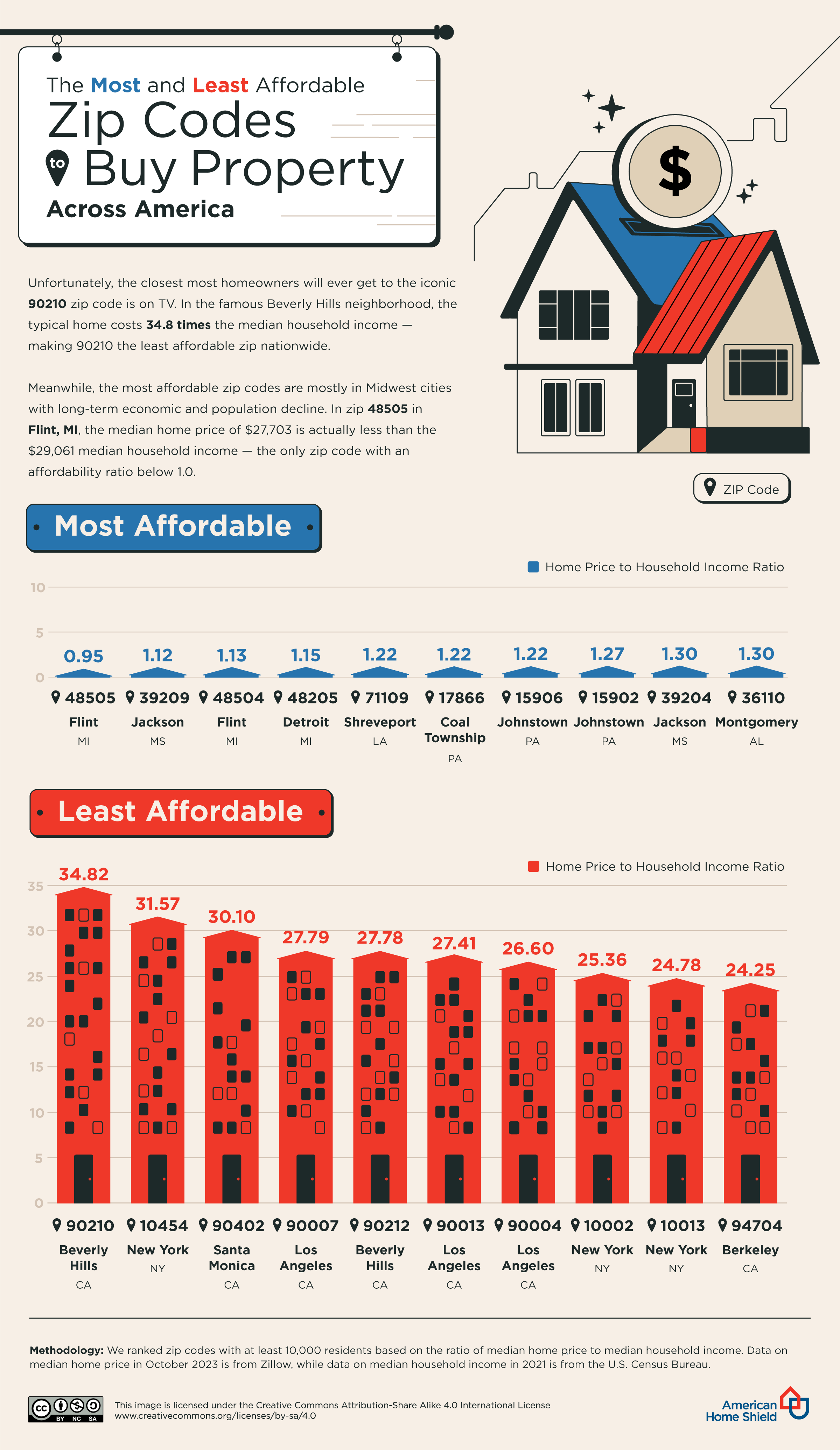

- The most affordable ZIP code in the country for locals to buy a house is 48505 in Flint, Michigan. The median house price is 0.95 times the median annual salary of a local worker.

- The least affordable is the 90210 ZIP code of Beverly Hills, Los Angeles, where a typical home costs 34.82 times what a typical local worker earns in a year.

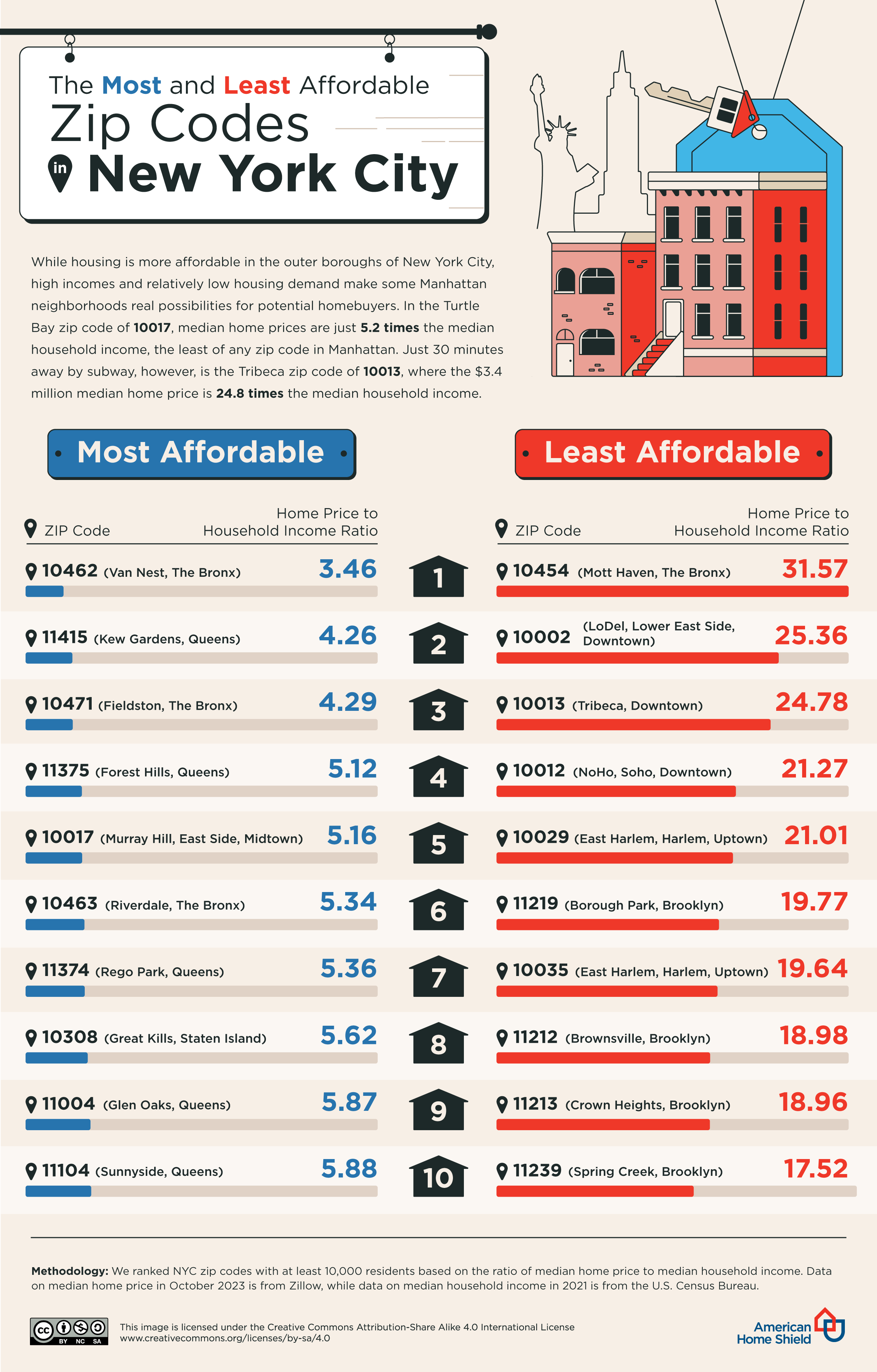

- In New York City, two ZIP codes in the Bronx are the most (10462) and least (10454) affordable for local residents to buy a home.

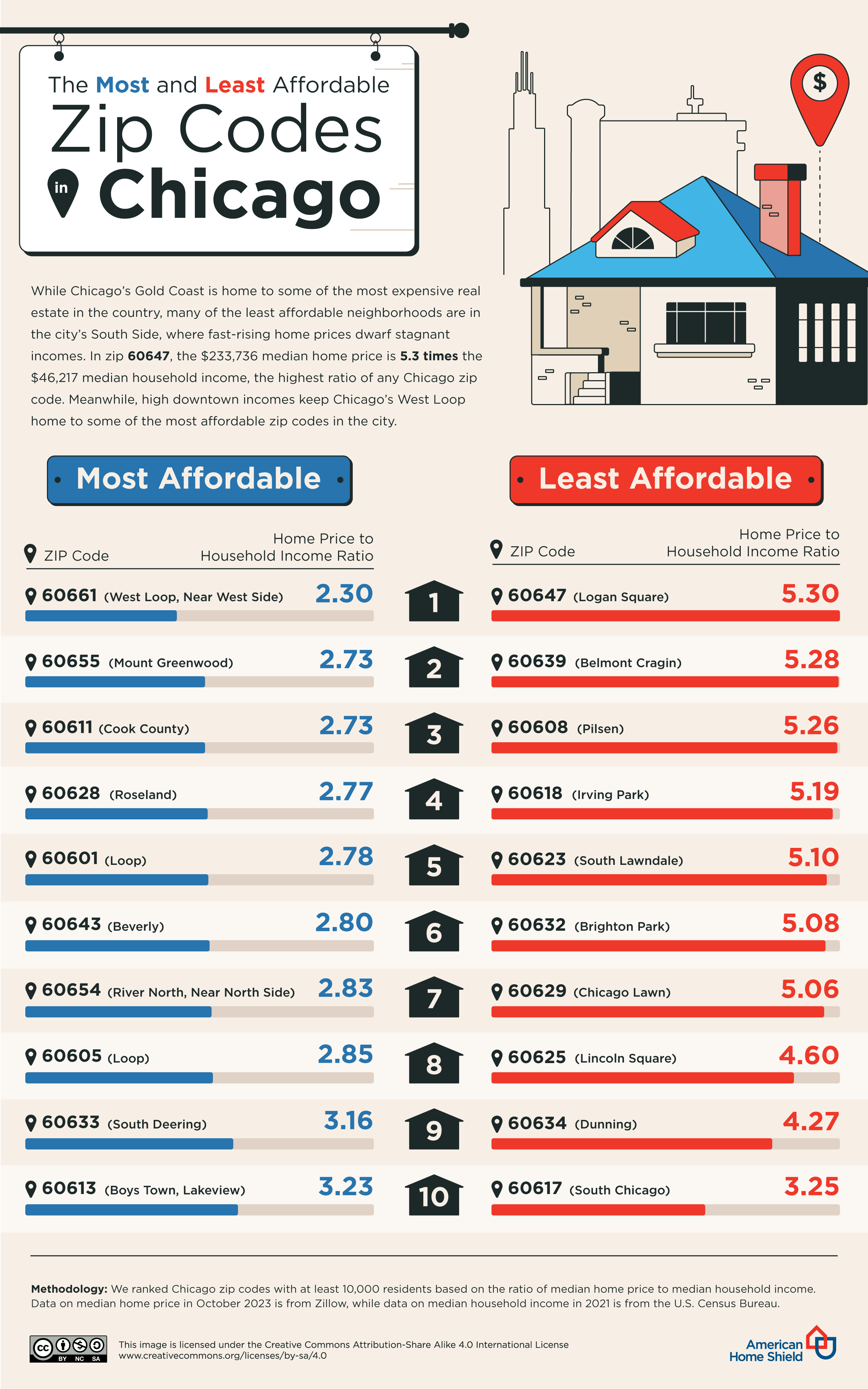

- In Chicago, 60661 (Near West Side) is the most affordable ZIP code, while 60629 (Logan Square) is the least affordable.

- In Houston, 77345 (Kingwood) is the most affordable ZIP code, while 77024 (around Piney Point Village) is the least affordable.

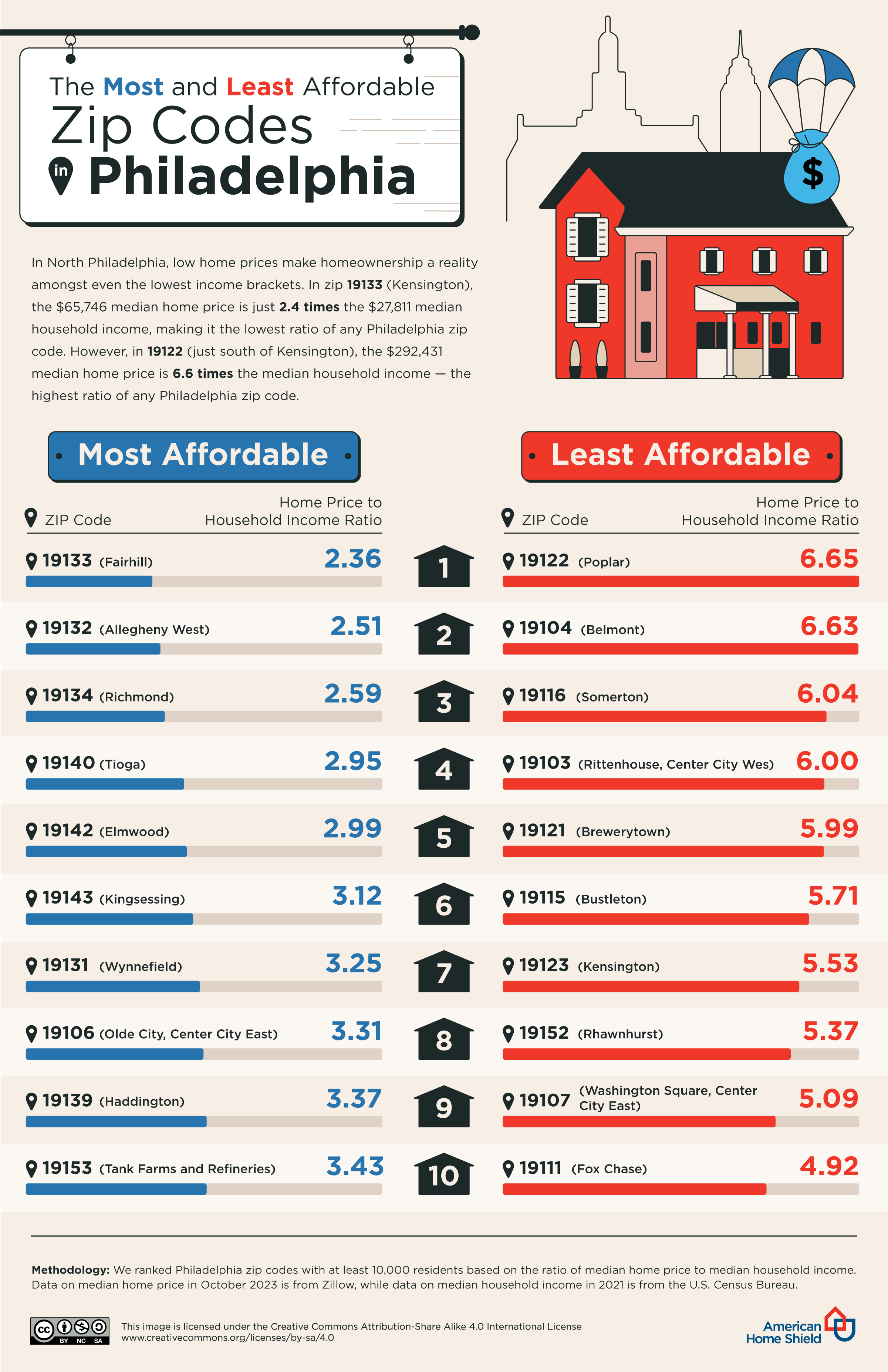

- In Philadelphia, 19133 (Fairhill) is the most affordable ZIP code, while 77024 (parts of Ludlow) is the least affordable.

Flint, Michigan, ZIP Code Is the Most Affordable Place in the U.S. for Locals To Buy Property

In the Flint, Michigan, ZIP code of 48505, the median price of a home ($27,703) is less than what a typical local worker makes annually ($29,061), making for a home price-to-household income ratio of 0.95. This earns the ZIP code the title of the most affordable in the country for locals to buy a house. Rocked by a crisis that saw the local water supply contaminated with lead and harmful bacteria, the population of the city as a whole has dropped, likely decreasing demand for housing.

After that, the ranking is mostly populated by ZIP codes in America’s Rustbelt, a region that suffered economically after the decline in heavy industry. The population has declined, too, but in recent years, millennials have been flocking to Rustbelt towns due to the cheaper housing.

Which Are the Most and Least Affordable ZIP Codes To Buy Property in America?

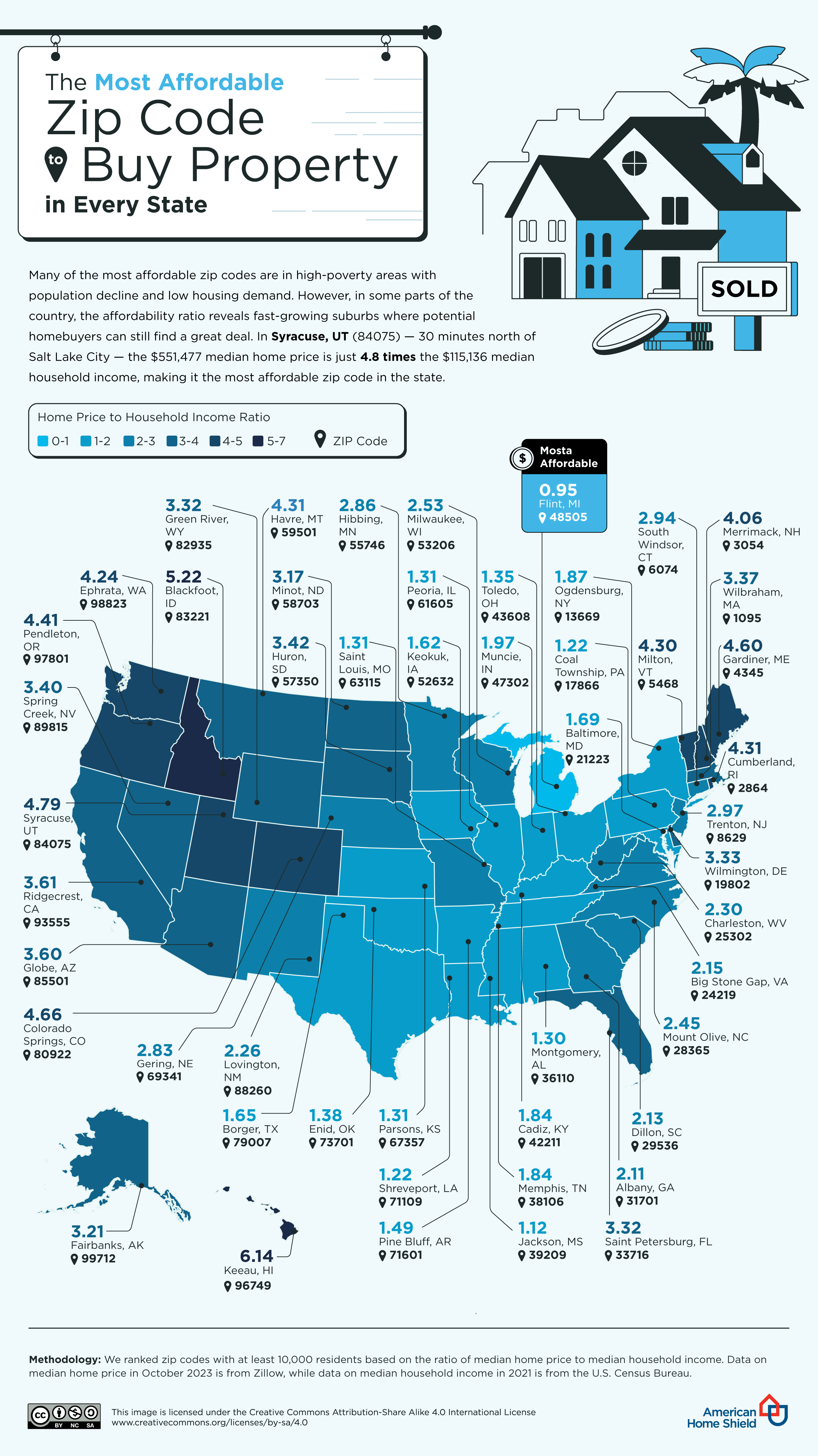

Our map below reveals the most affordable ZIP code in each state. In Texas — which has seen an influx of new residents this year — 79007 takes the title, a code found in the city of Borger. In 79007, a typical house costs just 1.65 times what the average local worker makes in a year. Even the wealthiest states have their more affordable ZIP codes; in the 6074 ZIP code of South Windsor, Connecticut, a typical home costs 2.94 times the local median annual salary.

poorest neighborhoods in Chicago), where a typical home goes on the market for 8.78 times a local person’s income. In Nevada, it’s the 89106 ZIP code of Las Vegas (9.58), and in Pennsylvania, it’s 15213 in Pittsburgh (10.10). Among the very least affordable ZIP codes on the map is 2554 in Nantucket, Maine (22.76).