Buying or selling a home can be an exciting time in your life. Moving often signifies a new beginning or important changes in someone's life.

When buying or selling a home, buyers and sellers need to agree on the sales terms and closing costs. One important detail that sometimes comes up is the home warranty.

So, what is a home warranty and is it always included in the closing costs? Let's take a look at what does a home warranty cover and who usually pays for it.

What Does a Home Warranty Cover?

A home warranty is a service agreement that covers the cost to repair major appliances and important home system components from normal wear and tear. The warranty is designed to provide protection against unexpected appliance failure.

For example, a homeowner might have difficulty financing a $4,000 central air conditioning unit if their air conditioner stops working. A good home warranty could allow the homeowner to have their air conditioning repaired instead at a lower cost.

The company providing the warranty could cover some or all of the costs for repairs, depending on the policy.

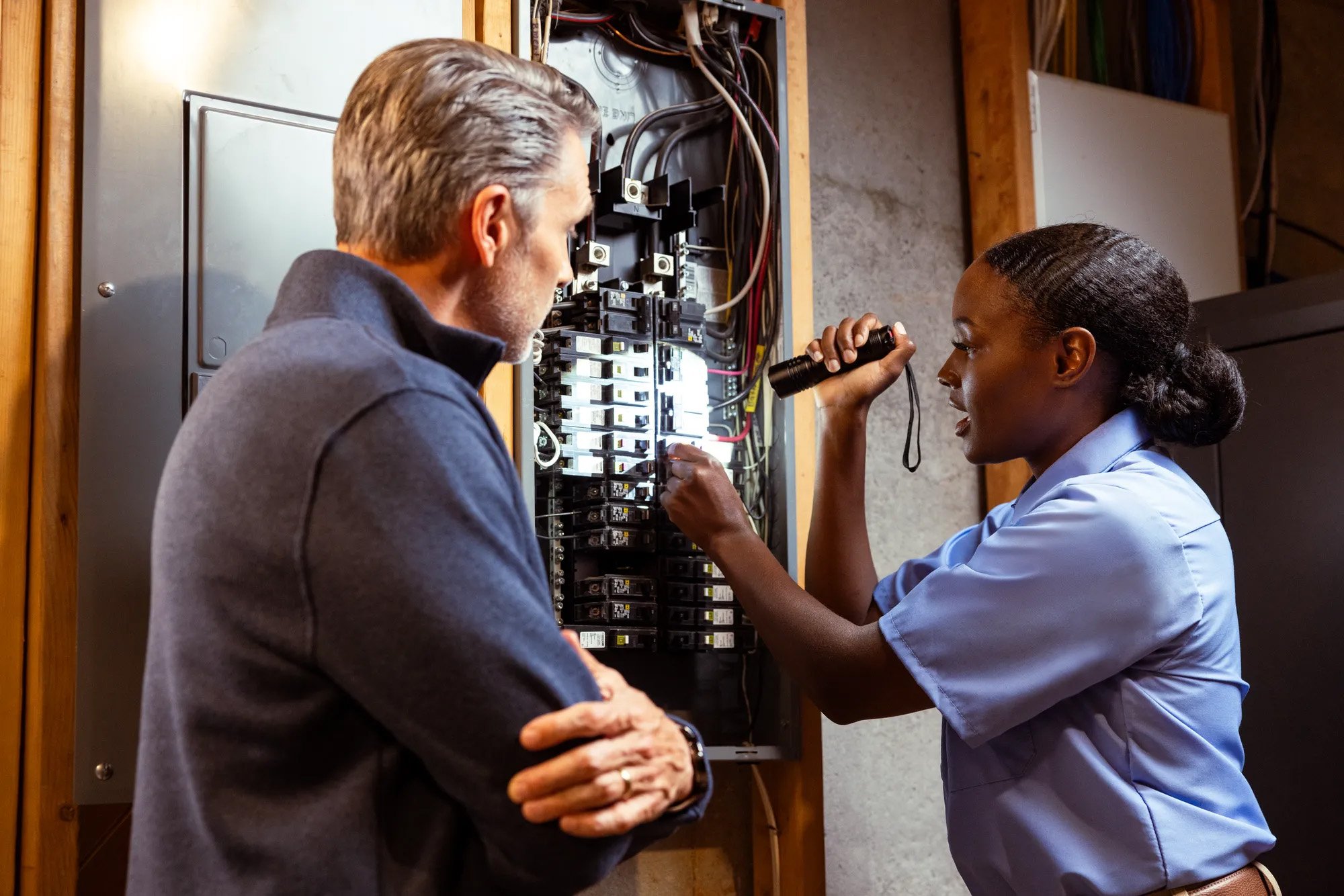

Some appliances typically covered in a home warranty include the refrigerator and freezer, washer and dryer, oven and stove, microwaves and the air conditioner and heater. Plumbing, roof leaks and electrical systems may also be covered in some home warranty policies.

Aside from potentially saving a lot of money on costly repairs, some people like having home warranties for the convenience. It can be nice having someone you can call when you need to have a covered item repaired.

Contracts are normally good for one year and can be renewed each year if desired.

A home warranty should not be confused with homeowner's insurance. Homeowner's insurance protects a home from natural disasters like fires and hurricanes, but does not cover appliance or system failure from normal wear and tear.

How Much is a Home Warranty?

The cost of a home warranty will vary depending on what policy you get and where you live. Standard plans can cost anywhere from $300 to $600 per year and upgrade plans can add an additional $100 - $500 to that cost.

You may need to purchase a second home warranty or additional coverage if you own a second refrigerator or swimming pool as these items are normally not covered under a standard home warranty. With American Home Shield®, however, items such as these are typically included as part of some of their plans at no additional cost.

Be sure to shop around to find the best deal for your home warranty. While cost may be a factor, the number of items covered and the additional services offered, as well as the home warranty company's reputation and quality of service, should also be considered.

Why Purchase a Home Warranty?

Real estate agents often recommend getting a home warranty for every real estate purchase.

Home warranties protect the seller from liability if appliances break down after the home purchase. Plus if something does break, the new homeowner can call the warranty company instead of calling the seller to get the issue resolved.

Warranties also give buyers the comfort and convenience of knowing that in the event of an appliance breakdown, the warranty will help reduce the cost of repairing or replacing the broken item.