Your homeowner’s insurance is there to protect your home from unexpected disasters. But confusion about what homeowners insurance covers and doesn’t cover can lead to costly surprises. While most policies cover major incidents like fire damage or theft, there are key exclusions that could leave you vulnerable. Let’s break it down, so you can protect your home without breaking the bank.

What does homeowners insurance typically cover?

Because insurance should protect you against significant financial losses in the wake of the unexpected, it’s important to know exactly what home insurance covers. Home insurance coverage typically includes:

Structural damage

This is the foundation (pun intended) of any homeowners insurance policy. If your home’s physical structure — the wall, roof, or foundation — suffers damage from covered threats like fire, windstorms, or hail, your insurance may step in to help pay for repairs or rebuilding costs.

This coverage may also extends to other structures on your property, such as a detached garage or shed. Keep in mind: damage from neglect, or general wear-and-tear, is not often covered by insurance.

Personal property protection

If your personal belongings are stolen, damaged, or destroyed by a covered event, homeowners insurance may help cover the replacement or repair costs. This typically includes items like furniture, electronics, and clothing. Some policies even provide coverage for personal property when you’re not at home, such as luggage stolen from your car.

While expensive items are also covered under this agreement, there are usually dollar limits if they are stolen. You might want to consider additional coverage if you have high-value items like jewelry or art.

Liability protection

If someone is injured on your property, homeowners insurance may cover legal fees and medical expenses if you’re found liable. This might apply to a guest slipping on an icy sidewalk or a neighbor being hurt while using your trampoline. The liability coverage in your policy is there to help protect you from lawsuits or settlements that could otherwise be costly.

Additional living expenses (ALE)

When your home becomes uninhabitable due to a covered peril, like a fire or severe storm, ALE coverage helps with temporary housing, food, and even moving costs while your home is being repaired. Keep in mind that ALE only applies to situations where damage is covered by your insurance policy, so maintenance-related issues wouldn’t qualify.

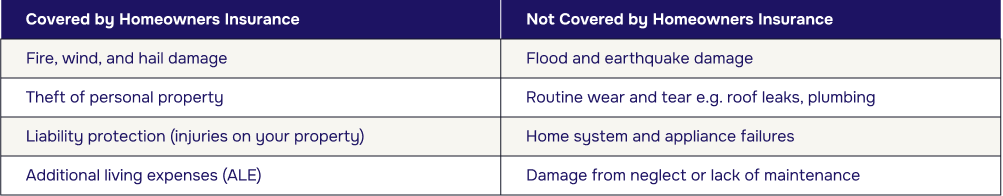

What’s not covered by homeowners insurance?

Now that we get what home insurance covers, it’s time to take a look at what things are unfortunately not often included in your coverage.

Flood and earthquake damage

Contrary to what many people think, standard homeowners insurance does not cover damage caused by floods or earthquakes. These types of natural disasters often require separate policies. If you live in a flood or earthquake-prone area, adding these insurances is vital so that you don’t face significant out-of-pocket expenses if a flood or quake damages your home.

Routine wear and tear

Insurance policies are designed for unexpected events, not the gradual breakdown of your home’s systems. Problems like roof leaks from aging shingles, worn-out plumbing, or a malfunctioning HVAC system usually aren’t covered.

Damage from neglect

If damage to your home occurs because of lack of upkeep, such as failing to repair a small leak that leads to bigger water damage, most homeowners insurance won’t cover the costs. Proper maintenance is key to keeping your home insurance coverage intact. Neglecting basic repairs or maintenance can even void parts of your policy, possibly leaving you with hefty bills.

Home system and appliance failures

Homeowners insurance usually doesn’t cover breakdowns of systems or appliances like your dishwasher, furnace, or electrical wiring. For instance, if your refrigerator dies suddenly or your heating system stops working, you’ll need to handle those repairs or replacements out of pocket — unless you have a home warranty.

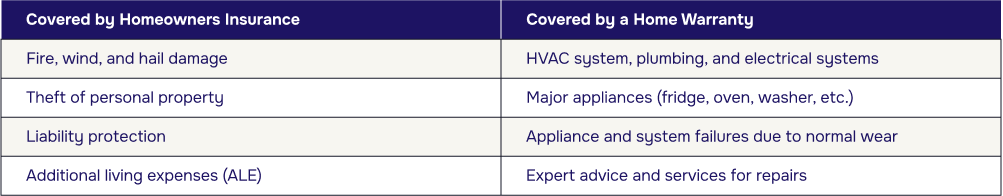

Quick Home Insurance Coverage Overview

Do you need additional coverage?

While homeowners insurance offers solid protection, it doesn’t cover everything. Depending on where you live and the value of your belongings, you may want to consider additional homeowners insurance coverage to protect against risks that aren’t included in your standard policy. Let’s explore a few key areas where extra coverage can make all the difference:

- Flood and Earthquake Insurance: If you live in an area prone to these disasters, separate policies are essential. Flood insurance, often offered through the National Flood Insurance Program (NFIP), can protect your home from rising waters, while earthquake insurance is crucial in high-risk areas like California.

- Wildfire Coverage: While most policies cover fire damage, homes in high-risk areas may face higher premiums or limited coverage. Some insurers require homeowners to purchase additional fire coverage, particularly if your area has experienced recent wildfires. Review your policy to ensure you're not underinsured.

- Coverage for High-Value Items: Most policies place limits on how much they will reimburse for valuable items like jewelry, art, or collectibles, meaning you could be left covering the gap in value if they’re lost or stolen. To protect high-value possessions, consider adding a rider or endorsement to your policy to make sure your valuables are protected for their full worth.

- Specialty Insurance for Home-Based Businesses: If you run a business from your home, your homeowners insurance may not cover business-related equipment or liability. Home-based business insurance can provide extra protection for equipment, inventory, and liability.