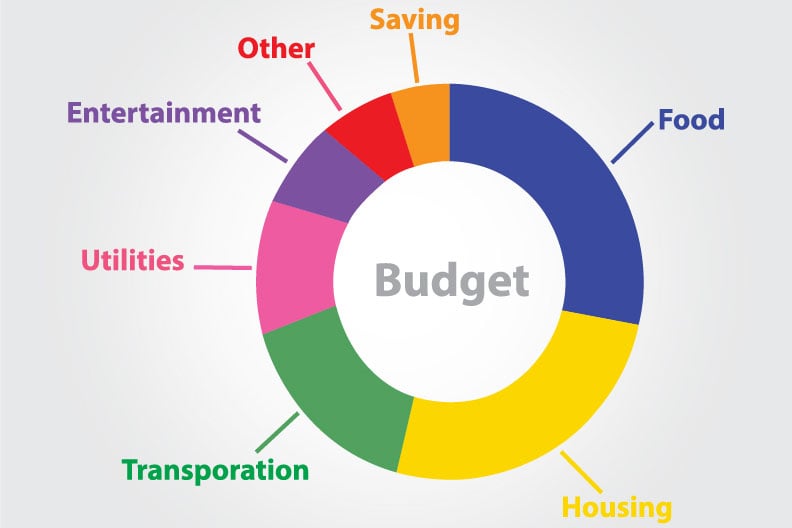

Most homeowners know that they should budget for expenses such as the mortgage, insurance, utilities, and taxes. However, many overlook another inevitable household expense – home -related repairs and replacements. If you fit within this category, read on for tips that can help you become financially prepared.

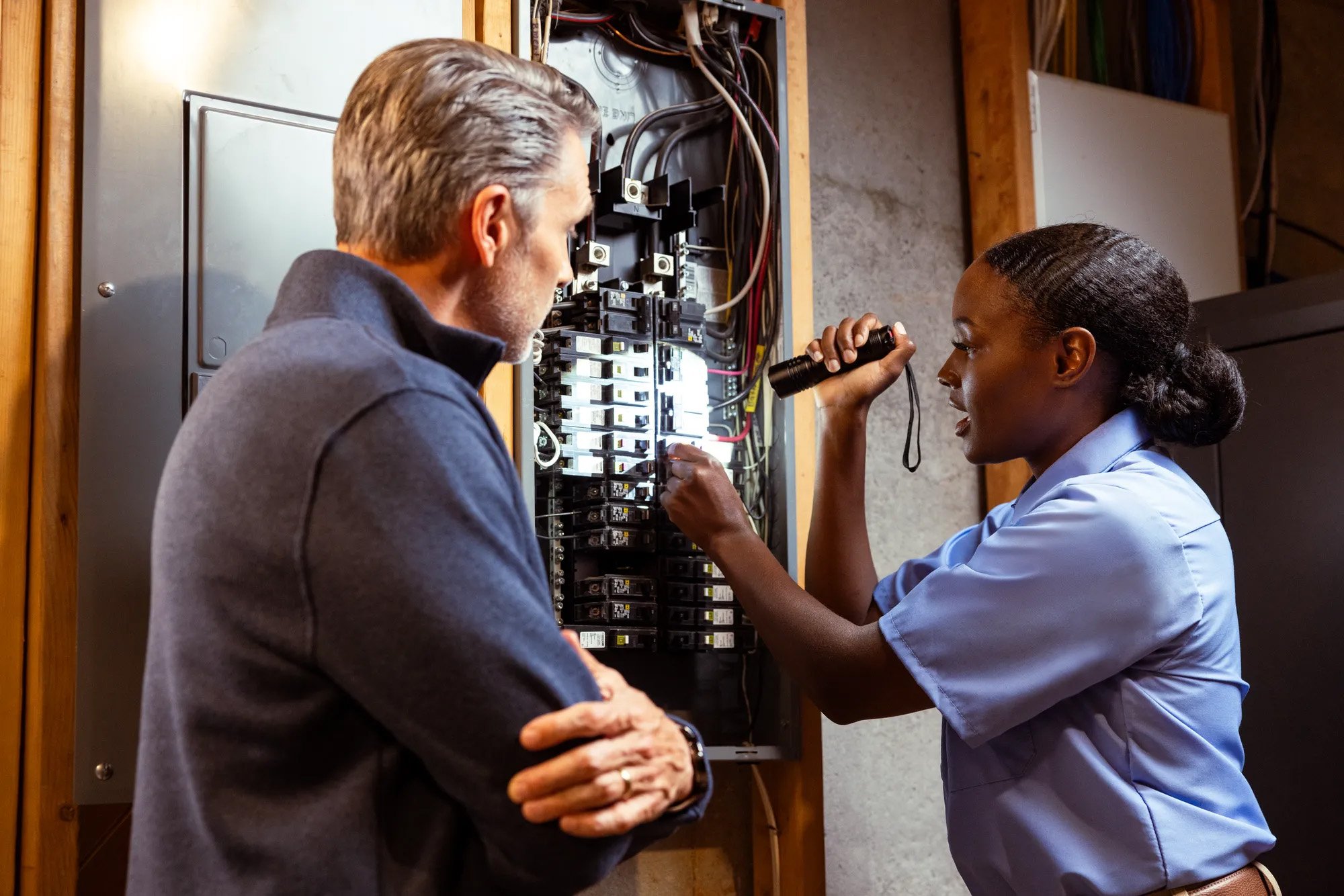

It’s a fact of life that home systems and appliances don’t last forever and that they will eventually break down, even from just normal, everyday wear and tear. Repairs or replacements can be expensive when that happens with a major system.

Add Home Repairs to Your Budget

It’s easy to see how just one breakdown can conceivably bust even the most well-executed financial plan. That’s why it’s a good idea to build allowances for unexpected home repair expenses into your household budget. Ideally, this line item should be in addition to any “emergency fund” set up for job loss or savings for other purposes.

Count the Potential Cost

Once you’ve established the need for budgeting for home system and appliance repairs and replacements, the question becomes how much money should you allocate for potential expenses. If you’ve been a homeowner for a number of years, one way to plan is to review your home-related repair, replacement, and maintenance expenses for the last several years and calculate an average yearly projection. Then, divide that average by 12 to determine how much of your monthly income you should set aside. If you have online banking, it could be as easy as running a quick report to track your spending habits over a period of time.

Some experts suggest setting aside one to two percent of the purchase price of your home for household maintenance to include unexpected repairs and replacements. So, if you paid $200,000 for your property, you would budget between $2,000 to $4,000 a year or $167 to $335 per month. Another common way to determine how much money to save for surprise home repairs is to base the amount on the square footage of your home.

With both of these approaches, it’s important to also consider some other factors that might influence how much you’ll need to spend. For example, if you have an older home that hasn’t been remodeled in a while, you may anticipate that more breakdowns will occur with the older systems and appliances and budget up to four percent of your home’s purchase price. Or, if you have a big ticket item maintenance item that’s looming, such as needing a new roof, you might need to save more in the years leading up to that expense. Conversely, if your home is new or if it has been recently remodeled or renovated with new systems and appliances, you might save on the lower end of the recommended scale.